Disputing

What Documents Should I Send with Dispute Letters To Get The Best Results?

Mike

Share:

Facebook

Twitter

LinkedIn

If you are serious about maximizing your credit repair efforts efficiently and affordably, Dispute Beast is the ultimate tool. Make sure to read the ultimate Dispute Beast FAQ to fully understand how you can leverage this powerful DIY Credit Repair system to transform your financial health!

When it comes to repairing your credit, the devil is often in the details. Sending out dispute letters is a crucial step, but what many overlook is the importance of accompanying documentation. In this guide, we’ll delve into the best documents to send with your dispute letters to maximize your chances of success, with a focus on ensuring accuracy and credibility. With Dispute Beast by your side, let’s unlock the full potential of your credit repair journey.

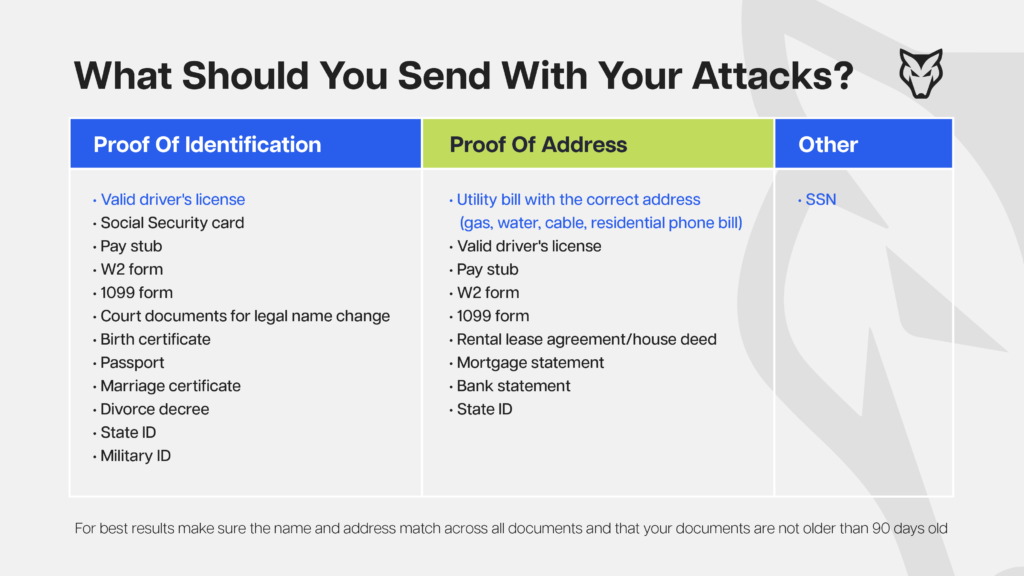

- Valid Driver’s License: One of the most fundamental documents to include with your dispute letters is a valid driver’s license. This serves as a primary form of identification and adds legitimacy to your dispute. Ensure that the information on your driver’s license matches the details on your credit report to avoid any discrepancies.

- Utility Bill: A recent utility bill with a matching address is another powerful piece of documentation to include. This can be a cell phone statement, water bill, or cable bill, among others. However, it’s essential to ensure that the utility bill is no older than 90 days to maintain relevance and validity. Consistency is key here – make sure the first and last name, as well as the address, match across all documents.

Examples:

- Cell phone statement: Provides proof of residence with up-to-date billing information.

- Water bill: Verifies your address and residency status within the specified time frame.

- Cable bill: Offers additional evidence of your address and residence for comprehensive validation.

- Social Security Number (SSN): While not always necessary, including your Social Security Number (SSN) can further authenticate your identity and streamline the verification process. This is especially beneficial if there are multiple individuals with similar names in your area.

By incorporating the right documentation with your dispute letters, you can significantly enhance the effectiveness of your credit repair efforts. With Dispute Beast guiding you every step of the way, ensure that your documents are accurate, relevant, and consistent to achieve optimal results.

Reminders!

- Read the Ultimate Dispute Beast FAQ for answers to all your questions!

- Get your free Dispute Beast account and start sending your attacks with the press of 1 button by going to https://disputebeast.com/ and clicking get started

- To continue using Dispute Beast, you must maintain an active and paid subscription to Beast Credit Monitoring at all times!

Keep Attacking: Don’t forget to keep up with those attacks every 40 days! Dispute Beast will take a good look at your report and go after any new negatives that have popped up. But hey, I know you might be wondering how long it takes to improve your credit. Let’s think of it like getting in shape. The best results come from consistently eating right and hitting the gym. Same goes for credit improvement. Dedicate 6-12 attack rounds while paying your bills on time, keeping your utilization low (between 1-6%), and limiting your inquiries. This combo should yield some amazing results. Remember, your credit score is a byproduct of your financial behavior. Just like the numbers on the scale fluctuate, your credit score will too. Stay focused, stay consistent, and you’ll see the results you deserve!

TRUSTED BY HUNDREDS

Get the Credit score of a Beast

Take the first step towards a better financial future today. You deserve financial freedom because you’re more than a credit score and Dispute Beast is here to help you achieve it.